Monetising Goodwill

Empowering places for civic renewal

Author: Jack Airey |

Monetising Goodwill

Empowering places for civic renewal

The question of how adult social care funding is put on a sustainable footing helped to define the 2017 General Election. Along with the NHS, it has become an issue totemic of wider choices around public spending and their impact on local services. Yet the long shadow of social care funding in the public and political domain hides a wider truth. Compared to other parts of the local state, social care funding has not been the epicentre of austerity. It has been relatively protected, with other services facing the most drastic spending reductions. They are services with fewer statutory responsibilities, like potholes, libraries and bins, but which people want and value no less.

Coupled with the recent reduction in the size of the state has been a creeping distrust in its efficacy. Although trust in central government has always been low, in recent years it has plunged to new depths. Breakdowns between election promises and governing realities have tainted political discourse. Not a month seems to pass without calls to ‘take the politics out of’ how one service or another is funded.

Both these trends are tugging at the fabric of civil society. For many, the services and assets that enrich life at the community level are being diminished. And yet there appears to be no situation in the near future where this is stopped or reversed. It is our opinion that this situation is unreflective of the nation and places that make it. The Brexit vote is often said to have shown a nation divided, but the campaign also demonstrated the importance of properly-funded public services to all.

It is our view the nation is a generous one, it just won’t always be directed to the nation or through the state. However global markets for labour, capital and culture may be, the desire to belong and contribute towards a place and wider community still holds strong. In the words of Edmund Burke, “To be attached to the subdivision, to love the little platoon we belong to in society, is the first principle (the germ as it were) of public affections. It is the first link in the series by which we proceed towards a love to our country and to mankind.”

Key points

Research for this report shows there is a gap between what people are willing to contribute towards funding local services and what they provide now. In this report we have defined this as goodwill. With extensive public polling, we have looked at the extent and shape of this gap, as well as how it can be monetised.

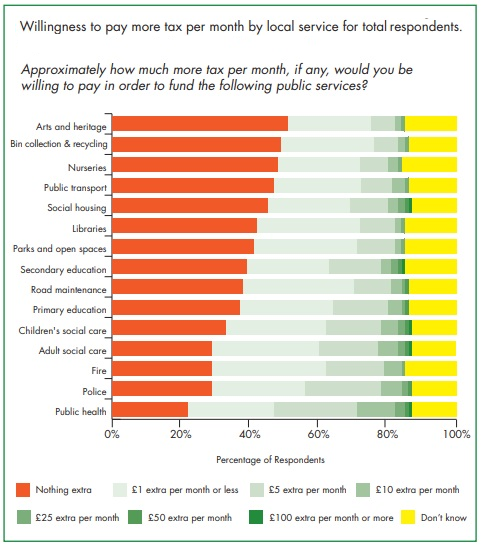

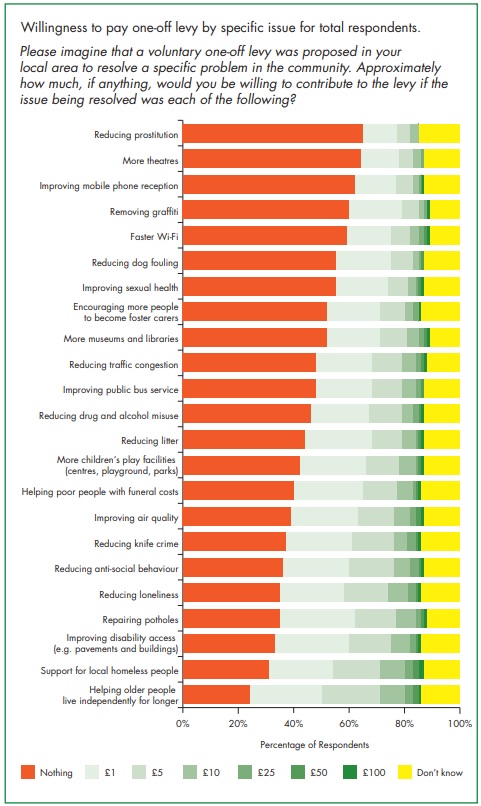

Our analysis shows people are willing to contribute more to their ‘little platoon’ when they know what it is spent on. As illustrated by the charts below, whether through extra payments in tax per month, or voluntarily via a one-off levy, there is a great deal of goodwill towards services like police and health; and issues like helping older people to live independently and supporting homeless people. This support is national, however goodwill looks different across the country. London and the East Midlands are the most willing to pay more, but certain services and issues seem especially important in some areas. Services for the lonely in Yorkshire and the Humber. Bin collection and recycling in the North West.

Policy recommendations

To engender local patriotism and enable a new programme of civic renewal, places should be empowered to monetise goodwill. This should involve three things.

Extending hypothecated local taxation:

- Government should relax its capping of council tax increases. Instead, the Secretary of State should set no cap at all, only an expectation that increases are tied to specific services and issues that reflect local public will. The Secretary of State should also consider setting different thresholds by service-need grounds or a willingness to contribute more.

- The GLA, mayoral combined authorities, county councils, local authorities and town and parish councils should be encouraged to explore the possibilities of levying hypothecated taxes and levies at the local level. We have identified services and issues that are likely to carry public support using the public polling conducted for the report. However, local areas and their leaders will know best which services and issues need funding most.

Providing citizens a more direct role in budget setting and priorities:

- Local authorities should use council tax administration forms to provide citizens with the opportunity to direct new and existing funding in line with their priorities. Billing authorities should consider the following options:

- Provide residents with the opportunity to direct up to twenty percent of total revenue raised to specific services and for achieving certain outcomes.

- Include the voluntary option to pay higher funding directed to specific services and issues, on top of the core bill. Billing authorities should limit the number of issues to pay for.

- Allow residents the opportunity to vote on specific spending packages. This would need to align with local elections.

Increasing contributions in the community and outside the formal bounds of the state:

- Local authorities should further integrate crowdfunding platforms, asset transfers and community share models with their community development plans. Each campaign should be tied to specific community renewal projects.

- Using their procurement, franchising and planning powers, local authorities should introduce contactless donation points in town and city centres. Donations should be tied to specific projects and issues, either via charities or other community organisations.